Let’s face it, folks—property taxes in Los Angeles County, CA, can be as confusing as a puzzle with missing pieces. Whether you're a first-time homeowner or a seasoned property owner, understanding how these taxes work is crucial for your financial health. Property taxes aren’t just numbers on a bill; they’re a significant part of your annual expenses. So, if you’re scratching your head trying to figure out what’s going on, you’re in the right place. We’re about to break it all down for you in a way that’s easy to digest.

Now, before we dive deep into the nitty-gritty, let’s talk about why this topic matters. Property taxes in LA County fund essential services like public schools, emergency services, and infrastructure. In short, they keep the city running smoothly. But here’s the kicker—how much you pay depends on several factors, including the assessed value of your property and local tax rates. Yep, it’s not one-size-fits-all, so buckle up because we’re about to take you on a ride through the world of LA County property taxes.

By the end of this guide, you’ll have a clear understanding of how property taxes work in Los Angeles County, what factors influence them, and how you can ensure you’re paying the right amount. This isn’t just about avoiding overpayment; it’s about being a smart and informed homeowner. Ready? Let’s get to it!

Read also:Is Tulsi Gabbard Married With Children Unveiling The Truth

Understanding Los Angeles County CA Property Taxes

First things first, let’s get a grip on what exactly we’re dealing with here. Property taxes in Los Angeles County are based on the assessed value of your property. This means that the government evaluates your home or land and assigns it a monetary value. That value is then used to calculate how much you owe in taxes. Now, here’s the twist—the assessed value isn’t always the same as the market value. Confusing, right? But don’t worry, we’ll untangle this mess for you.

How Are Property Taxes Calculated?

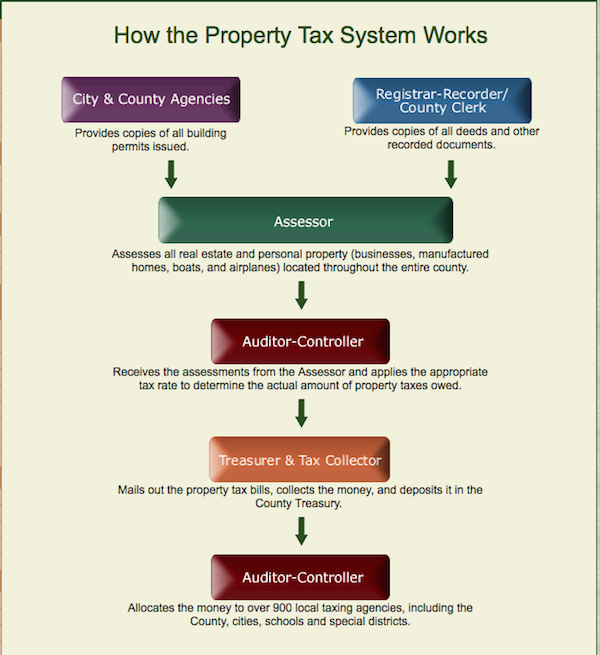

The calculation of property taxes in LA County involves a few key steps. First, the county assessor determines the assessed value of your property. This is typically done by comparing your property to similar ones in the area. Next, the assessed value is multiplied by the tax rate, which is set by the local government. The result? Your property tax bill.

- Assessed Value: Think of this as the baseline for your tax calculation.

- Tax Rate: This varies depending on where you live within the county.

- Total Tax Owed: Multiply the assessed value by the tax rate, and voilà—you’ve got your bill.

It’s worth noting that the tax rate can fluctuate based on changes in local government budgets and voter-approved measures. So, staying informed is key to avoiding any unpleasant surprises.

Key Factors That Influence Los Angeles County CA Property Taxes

Okay, now that we’ve got the basics down, let’s talk about the factors that can affect your property tax bill. These aren’t just random numbers; they’re influenced by a variety of things, from location to property improvements. Here’s a closer look at what can make your tax bill go up or down:

Location, Location, Location

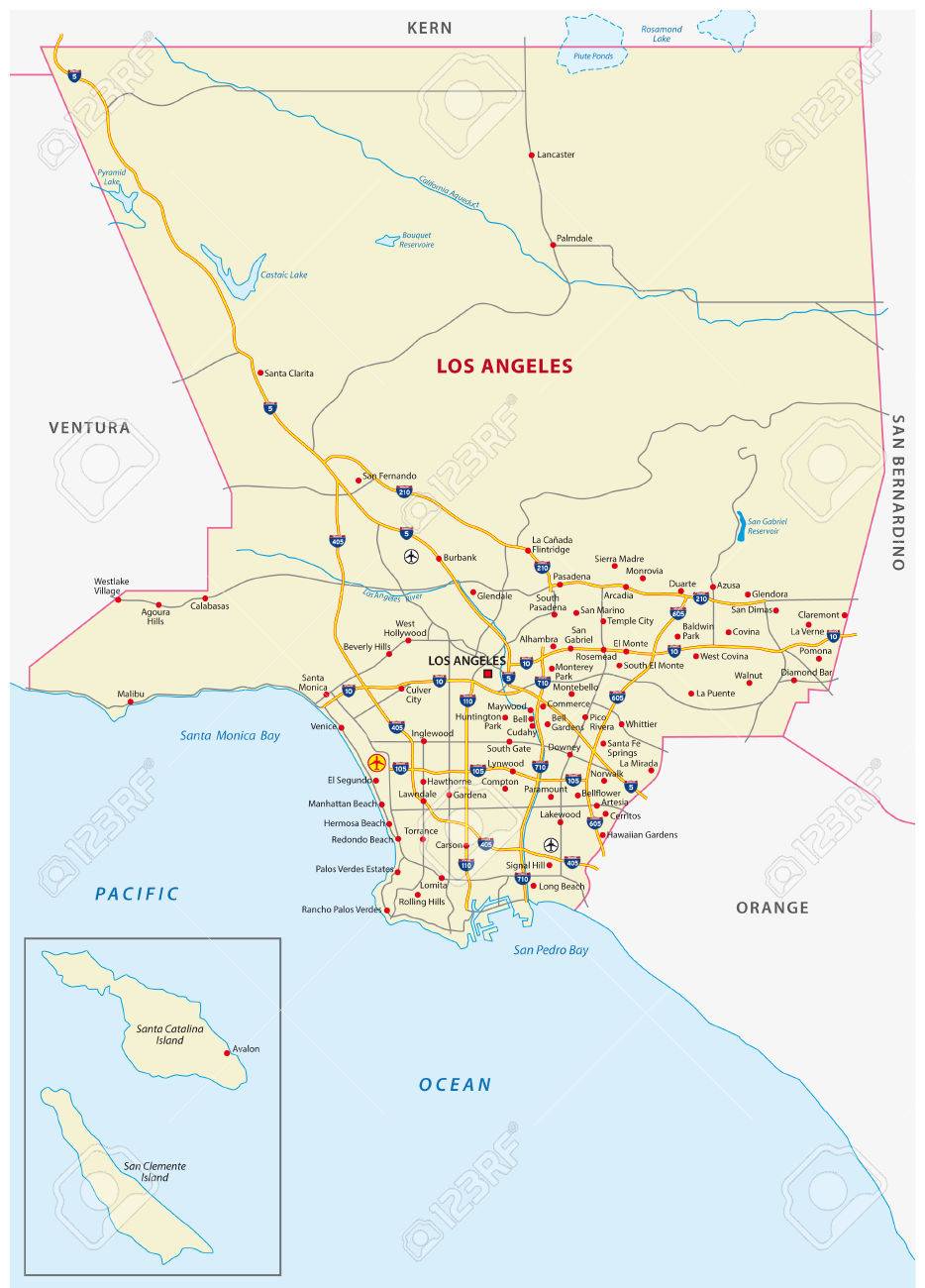

Where your property is located plays a huge role in determining your property taxes. Different areas within Los Angeles County have different tax rates. For example, properties in Beverly Hills might have a higher tax rate than those in Palmdale. It’s all about the amenities and services provided in the area. So, if you’re lucky enough to live in a neighborhood with top-notch schools and shiny new parks, chances are your taxes will reflect that.

Property Improvements

Think adding a pool or remodeling your kitchen is a great idea? It probably is, but it can also bump up your property taxes. Any significant improvements you make to your home can increase its assessed value, which in turn raises your tax bill. It’s like a double-edged sword—improve your home, but be prepared to pay a little extra for the privilege.

Read also:Oregon Ducks Basketball Roster Your Ultimate Guide To The Ducks Lineup

The Role of Proposition 13

Let’s talk about Proposition 13, a game-changer in the world of California property taxes. Passed in 1978, this law limits how much property taxes can increase each year. Essentially, it caps the annual increase at 2%, which is a huge relief for homeowners. But here’s the catch—it only applies to the assessed value, not the market value. So, if you’ve owned your home for a long time, your assessed value might be significantly lower than what your house is actually worth.

How Proposition 13 Affects You

For long-time homeowners, Proposition 13 is a lifesaver. It means your property taxes won’t skyrocket even if the housing market does. However, for new buyers, it can create a bit of a disparity. You might end up paying more in taxes than your neighbor who’s owned their home for decades. It’s a quirk of the system, but one that’s important to understand.

Common Myths About Los Angeles County CA Property Taxes

There’s a lot of misinformation floating around about property taxes in LA County. Let’s bust some of those myths right now:

Myth #1: Property Taxes Are Fixed

Wrong! Property taxes can and do change. They’re based on the assessed value of your property, which can fluctuate due to market conditions, improvements, or changes in tax rates.

Myth #2: You Can’t Appeal Your Tax Bill

Not true! If you believe your property has been over-assessed, you have the right to appeal. The process can be a bit involved, but it’s definitely worth it if you’re being overcharged.

Steps to Appeal Your Property Tax Assessment

Think your property taxes are too high? Here’s how you can fight back:

Gather Evidence

Start by collecting evidence that supports your case. This could include recent sales of similar properties in your area or an independent appraisal. The more data you have, the stronger your argument will be.

File an Appeal

Once you’ve got your evidence together, it’s time to file an appeal with the Los Angeles County Assessor’s Office. Be sure to follow their guidelines carefully to ensure your appeal is considered.

Understanding Your Property Tax Bill

When your property tax bill arrives, it can look like a foreign language. But don’t panic—we’re here to translate it for you:

Breaking Down the Bill

Your bill will typically include the assessed value of your property, the tax rate, and any additional assessments or fees. Take the time to review each section carefully. If something doesn’t add up, don’t hesitate to reach out to the county for clarification.

Tips for Managing Property Taxes

Here are a few tips to help you manage your property taxes effectively:

- Stay informed about changes in tax rates and local government budgets.

- Regularly review your property’s assessed value to ensure it’s accurate.

- Consider setting aside money each month to cover your tax bill.

By taking these steps, you can avoid last-minute stress and ensure you’re prepared when your bill arrives.

Resources for Los Angeles County CA Property Tax Information

There are plenty of resources available to help you navigate the world of property taxes in LA County:

Los Angeles County Assessor’s Office

This is your go-to source for all things property tax-related. Their website offers a wealth of information, including assessment tools and appeal guidelines.

Local Tax Professionals

If you’re feeling overwhelmed, consider consulting with a local tax professional. They can provide personalized advice and help you navigate the complexities of property taxes.

Conclusion

In conclusion, understanding Los Angeles County CA property taxes is essential for any homeowner. By staying informed and taking proactive steps, you can ensure you’re paying the right amount and avoiding unnecessary expenses. Remember, knowledge is power, and in this case, it can save you money.

So, what’s next? Take a moment to review your property tax bill and make sure everything is in order. If you have questions or concerns, don’t hesitate to reach out to the county or a tax professional. And hey, if you found this guide helpful, be sure to share it with your fellow homeowners. Let’s make sure everyone in LA County is armed with the information they need to tackle property taxes head-on.

Oh, and one last thing—drop a comment below if you’ve got any tips or tricks for managing property taxes. We’d love to hear from you!

Table of Contents

- Los Angeles County CA Property Taxes: A Comprehensive Guide for Smart Homeowners

- Understanding Los Angeles County CA Property Taxes

- How Are Property Taxes Calculated?

- Key Factors That Influence Los Angeles County CA Property Taxes

- Location, Location, Location

- Property Improvements

- The Role of Proposition 13

- How Proposition 13 Affects You

- Common Myths About Los Angeles County CA Property Taxes

- Myth #1: Property Taxes Are Fixed

- Myth #2: You Can’t Appeal Your Tax Bill

- Steps to Appeal Your Property Tax Assessment

- Gather Evidence

- File an Appeal

- Understanding Your Property Tax Bill

- Breaking Down the Bill

- Tips for Managing Property Taxes

- Resources for Los Angeles County CA Property Tax Information

- Los Angeles County Assessor’s Office

- Local Tax Professionals

- Conclusion