Ever found yourself scratching your head over a mysterious charge on your Apple Pay? Don’t worry, you’re not alone! Dispute Apple Pay transaction issues can pop up when least expected, leaving you wondering how to navigate the process. Whether it’s a charge you didn’t authorize or a billing error, knowing how to handle it is key. In this guide, we’ll break down everything you need to know about disputing transactions, step by step, so you can get your money back and protect your wallet.

Apple Pay has revolutionized the way we pay for stuff, making transactions seamless and secure. But even the best systems can have hiccups. Sometimes, charges slip through that aren’t legit, or maybe you accidentally tapped twice at the checkout. Whatever the case may be, it’s important to know your rights and how to dispute those charges.

By the end of this article, you’ll have a solid understanding of the process, including tips and tricks to make disputing Apple Pay transactions as smooth as possible. So, grab a cup of coffee, and let’s dive into the world of digital payments and how to safeguard your finances!

Read also:Joe Rogan Weight And Height The Inside Scoop Youve Been Waiting For

Understanding Apple Pay and Its Transaction System

Before we jump into the nitty-gritty of disputing transactions, let’s take a moment to understand how Apple Pay works. Apple Pay uses a technology called NFC (Near Field Communication) to allow contactless payments. When you tap your device, whether it’s an iPhone or Apple Watch, at a payment terminal, it securely transmits your payment information to complete the transaction.

One of the coolest features of Apple Pay is its security. Instead of using your actual credit or debit card number, Apple Pay assigns a unique Device Account Number. This number is encrypted and stored securely, adding an extra layer of protection. However, even with all these safeguards, disputes can still arise.

Common Reasons for Disputing Apple Pay Transactions

So, what are the most common reasons people end up needing to dispute Apple Pay transactions? Here’s a quick rundown:

- Unauthorized charges: Someone accessed your account without permission.

- Double charges: Accidentally tapping twice or a merchant error.

- Incorrect amounts: Charges that don’t match what you were expecting.

- Non-receipt of goods: You paid, but the product or service never showed up.

Knowing these reasons can help you identify if something is off in your transaction history. Let’s move on to how you can start the dispute process.

Step-by-Step Guide to Dispute Apple Pay Transaction

Disputing a transaction might sound intimidating, but with the right steps, it’s actually pretty straightforward. Here’s a detailed guide to help you through the process:

Step 1: Check Your Transaction History

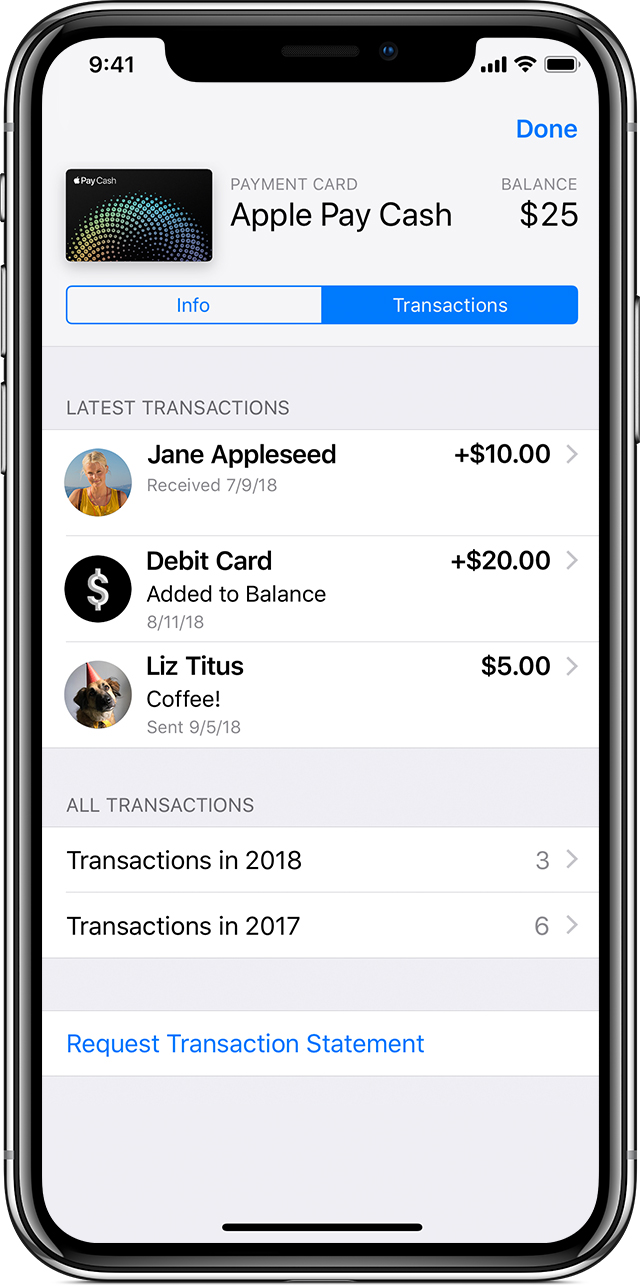

The first thing you should do is review your transaction history. Open the Wallet app on your iPhone, tap on the card you used, and scroll through your recent transactions. Look for any charges that seem suspicious or incorrect.

Read also:Dilbert Comics A Mustread For Every Office Worker Looking To Survive The Madness

Step 2: Gather Necessary Information

Once you’ve identified the problematic charge, gather all the relevant details. This includes the transaction date, amount, merchant name, and any receipts or confirmations you may have received.

Step 3: Contact Your Bank or Card Issuer

Apple Pay itself doesn’t handle disputes directly. Instead, you’ll need to contact the bank or financial institution that issued your card. Most banks have a dedicated customer service team to assist with disputed transactions.

Here’s how you can reach out:

- Call the number on the back of your card.

- Log in to your bank’s mobile app or website and initiate a dispute request.

- Send an email or message through your bank’s support channels.

Step 4: Provide Documentation

When disputing a transaction, providing documentation can strengthen your case. Attach any receipts, screenshots, or other relevant evidence to support your claim. The more detailed you are, the better your chances of a successful resolution.

Tips for a Successful Dispute

While the process might seem straightforward, there are a few tips and tricks that can increase your chances of success:

Act Quickly

Time is of the essence when it comes to disputing charges. Most banks have a specific window, usually 60 days, to file a dispute. The sooner you act, the better your chances of getting a favorable outcome.

Be Polite but Persistent

When dealing with customer service reps, it’s important to maintain a polite tone. However, don’t be afraid to follow up if you don’t hear back within a reasonable timeframe. Persistence can often lead to results.

Keep Records

Document every step of the process. Save emails, call logs, and any other communication you have with your bank. This can be invaluable if the dispute escalates or requires further investigation.

What Happens After You Dispute an Apple Pay Transaction?

Once you’ve filed a dispute, what happens next? Your bank will review your case and investigate the transaction. This can take anywhere from a few days to several weeks, depending on the complexity of the issue.

During this time, your bank may place a temporary hold on the disputed amount. If the investigation concludes in your favor, the funds will be refunded to your account. If not, you’ll receive an explanation of the decision.

What If the Dispute Is Denied?

Don’t lose hope if your initial dispute is denied. You can usually request a review or appeal the decision. Gather any additional evidence you may have and present it to your bank. Sometimes, a second look can make all the difference.

How Secure Is Apple Pay Against Fraudulent Charges?

Apple Pay is one of the most secure payment methods available, thanks to its use of tokenization and biometric authentication. However, no system is completely immune to fraud. That’s why it’s crucial to monitor your transactions regularly and report any suspicious activity immediately.

Apple also offers a feature called “Lost Mode,” which allows you to remotely lock your device and prevent unauthorized transactions if your phone is lost or stolen. This adds another layer of protection to your digital wallet.

Preventing Unauthorized Transactions

Here are some tips to help you prevent unauthorized Apple Pay transactions:

- Enable Face ID or Touch ID for added security.

- Regularly review your transaction history for any discrepancies.

- Set up alerts for large or unusual purchases.

- Keep your device and apps updated with the latest security patches.

Understanding Your Rights as a Consumer

As a consumer, you have certain rights when it comes to disputing transactions. The Fair Credit Billing Act (FCBA) and the Electronic Fund Transfer Act (EFTA) protect you from unauthorized charges and billing errors. These laws ensure that you have a fair chance to contest charges and recover your funds.

Knowing your rights can empower you to take action confidently. If you feel your rights have been violated, don’t hesitate to escalate the issue to higher authorities, such as the Consumer Financial Protection Bureau (CFPB).

Real-Life Examples of Successful Disputes

Let’s look at a couple of real-life examples where people successfully disputed Apple Pay transactions:

Example 1: Double Charge at a Coffee Shop

Jane noticed a double charge at her favorite coffee shop. She gathered her receipt and called her bank immediately. After providing the documentation, her bank refunded the extra charge within a week.

Example 2: Unauthorized Subscription

Mark discovered a recurring subscription charge he didn’t authorize. He contacted his bank, provided proof of the unauthorized subscription, and had the charges reversed. The bank also helped him cancel the subscription to prevent future charges.

Common Mistakes to Avoid When Disputing Apple Pay Transactions

While disputing transactions, it’s easy to make mistakes that could harm your case. Here are a few common pitfalls to avoid:

- Waiting too long to file a dispute.

- Not providing enough documentation or evidence.

- Being rude or aggressive with customer service reps.

- Ignoring follow-up requests from your bank.

By avoiding these mistakes, you can increase your chances of a successful resolution.

Conclusion: Take Control of Your Finances

Disputing Apple Pay transactions doesn’t have to be a daunting task. With the right knowledge and approach, you can protect your finances and ensure you’re not overcharged or scammed. Remember to act quickly, gather all necessary documentation, and maintain open communication with your bank.

Don’t forget to share this article with friends and family who might benefit from the information. If you have any questions or experiences you’d like to share, drop a comment below. Let’s keep our wallets safe and our minds at ease!

Table of Contents

- Understanding Apple Pay and Its Transaction System

- Common Reasons for Disputing Apple Pay Transactions

- Step-by-Step Guide to Dispute Apple Pay Transaction

- Tips for a Successful Dispute

- What Happens After You Dispute an Apple Pay Transaction?

- How Secure Is Apple Pay Against Fraudulent Charges?

- Understanding Your Rights as a Consumer

- Real-Life Examples of Successful Disputes

- Common Mistakes to Avoid When Disputing Apple Pay Transactions

- Conclusion: Take Control of Your Finances