Imagine having a financial tool that offers flexibility, security, and convenience—all in one package. That's exactly what a prepaid Chase card brings to the table. Whether you're looking to manage your finances smarter or simply want a safer way to spend, this card could be your go-to solution. In today's fast-paced world, having control over your money has never been more important, and prepaid cards are stepping up to meet that need.

Now, you might be wondering, "What makes a prepaid Chase card different from other financial products?" Great question! Unlike traditional credit cards, prepaid cards don't require a credit check, meaning they're accessible to almost everyone. Plus, they offer a budget-friendly approach to spending by only allowing you to use the funds you load onto the card. It's like carrying cash, but way more secure.

But here's the kicker: not all prepaid cards are created equal. The Chase prepaid card stands out with its robust features, user-friendly design, and the backing of one of the most trusted financial institutions in the world. In this guide, we'll dive deep into everything you need to know about prepaid Chase cards, from their benefits to how you can make the most of them. Let's get started!

Read also:Arielle Kebbel Relationships The Untold Story Of Love Fame And Connection

Contents:

- What is a Prepaid Chase Card?

- Benefits of Using a Prepaid Chase Card

- How to Get a Prepaid Chase Card

- Understanding Fees and Charges

- Security Features of Prepaid Chase Cards

- Prepaid Chase Card vs. Other Cards

- Who Should Use a Prepaid Chase Card?

- Tips for Maximizing Your Prepaid Chase Card

- Common Questions About Prepaid Chase Cards

- The Future of Prepaid Chase Cards

What is a Prepaid Chase Card?

Alright, let's break it down. A prepaid Chase card is essentially a debit card that you load with funds before you spend. Think of it as a digital wallet where you deposit money upfront, and then use it wherever Visa or Mastercard is accepted. It’s super handy for people who want to avoid debt or simply prefer a cashless lifestyle without the hassle of carrying actual cash.

One of the coolest things about prepaid Chase cards is that they’re not tied to a bank account. That means no overdraft fees, no worries about bouncing checks, and no credit checks when you apply. Plus, since Chase is a well-known and trusted name in the financial world, you know you’re getting a reliable product.

Key Features of Prepaid Chase Cards

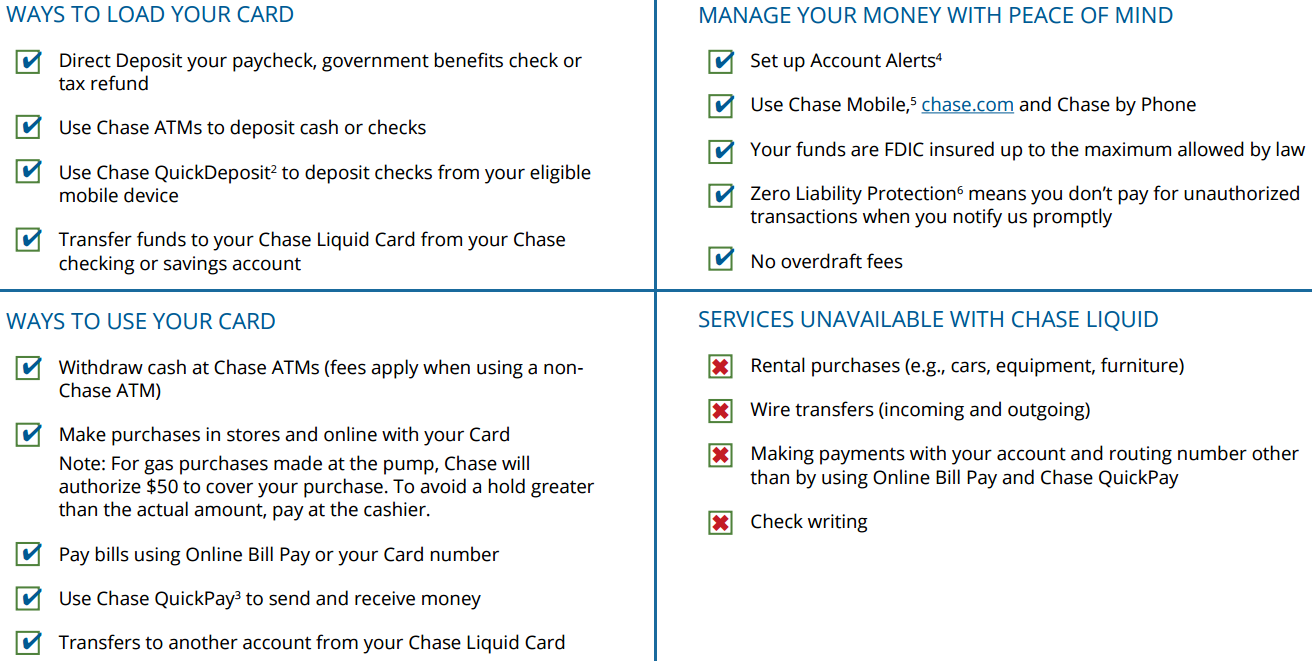

- Load funds easily via bank transfer, cash, or paycheck direct deposit.

- Access to a mobile app for real-time account management.

- Zero monthly fees if you meet certain conditions.

- Free access to over 16,000 Chase ATMs nationwide.

And guess what? Prepaid Chase cards come with purchase protection, fraud monitoring, and other security features that make them a safe choice for everyday spending. Now that’s what I call peace of mind!

Benefits of Using a Prepaid Chase Card

So, why should you consider getting a prepaid Chase card? Let me tell you, the perks are pretty sweet. First off, it’s an excellent tool for budgeting. Since you can only spend what you’ve loaded onto the card, it helps you keep track of your expenses and stick to your financial goals. No more accidental overspending!

Another big advantage is accessibility. Whether you have a solid credit history or none at all, you can still qualify for a prepaid Chase card. It’s a great option for students, young professionals, or anyone looking to build or rebuild their credit without the risk of debt.

Read also:Pioneer Woman Death The Truth Behind The Headlines And What You Need To Know

Top Benefits in a Nutshell

- Easy to apply for, even without a credit check.

- Helps you manage your finances more effectively.

- Secure and protected against fraud.

- Accepted worldwide wherever Visa or Mastercard is used.

Plus, let’s not forget the convenience factor. You can load your card with funds from multiple sources, including direct deposit, cash reloads, and bank transfers. And with the Chase mobile app, you can monitor your transactions, check your balance, and even lock or unlock your card with just a few taps.

How to Get a Prepaid Chase Card

Getting a prepaid Chase card is a breeze. First, head over to the Chase website or download the Chase mobile app. From there, you can apply online in just a few simple steps. All you need is some basic personal information, like your name, address, Social Security number, and date of birth.

Once you’ve submitted your application, you’ll typically receive an approval decision within minutes. After that, your card will be shipped to your address, and you’ll receive a temporary card number via email or text. You can start loading funds and using the card right away, even before the physical card arrives.

Steps to Apply

- Visit the Chase website or download the Chase app.

- Fill out the application form with your personal details.

- Choose how you want to load funds onto your card.

- Wait for your card to arrive in the mail (usually takes 7-10 business days).

Pro tip: If you sign up for direct deposit, you might qualify for additional perks, like waived monthly fees or bonus cashback offers. Definitely worth considering if you’re planning to use the card regularly.

Understanding Fees and Charges

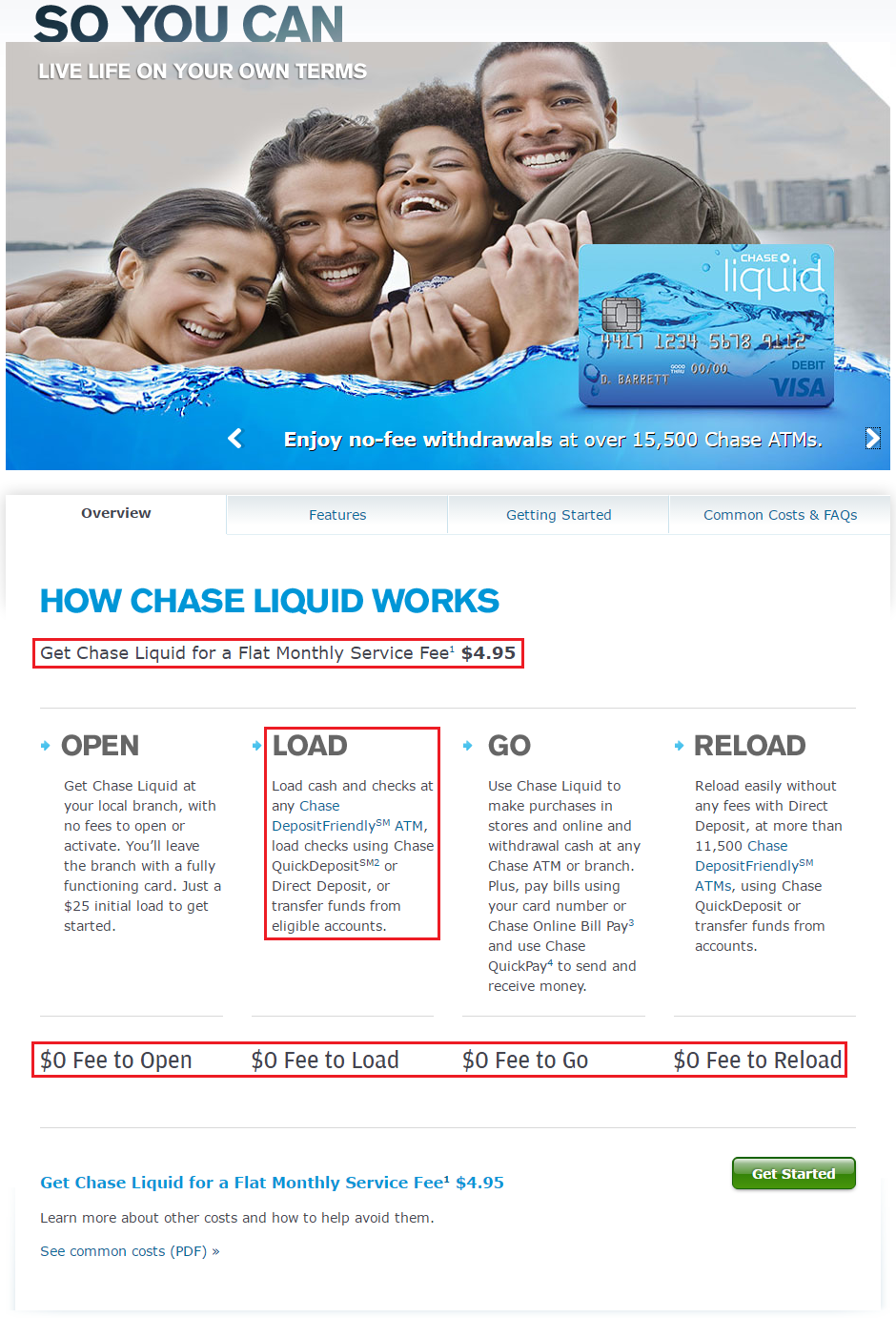

Now, let’s talk about fees. While prepaid Chase cards are generally affordable, there are a few charges you should be aware of. The good news is that many of these fees can be avoided if you meet certain conditions, like setting up direct deposit or using Chase ATMs for withdrawals.

Here’s a breakdown of the most common fees:

- Monthly fee: $4.95 unless you load $500 or more per month or set up direct deposit.

- ATM withdrawal fee: $2.50 per transaction at non-Chase ATMs.

- Cash reload fee: Up to $4.95 per transaction, depending on the reload network.

- Foreign transaction fee: 3% of the transaction amount for purchases made in foreign currencies.

While these fees might sound like a bummer, they’re actually pretty standard in the prepaid card industry. And hey, compared to some other cards out there, Chase’s fees are pretty reasonable. Just make sure to read the fine print and plan accordingly to avoid unnecessary charges.

Security Features of Prepaid Chase Cards

When it comes to financial products, security is always a top priority. Luckily, prepaid Chase cards come packed with features to keep your money safe. For starters, each card is protected by a unique PIN that you can change at any time. If your card is ever lost or stolen, you can quickly freeze it through the Chase app or by calling customer service.

On top of that, Chase offers zero liability protection for unauthorized transactions. That means if someone uses your card without permission, you won’t be held responsible for the charges. Plus, the card is equipped with chip-and-PIN technology, making it harder for fraudsters to clone.

Security Highlights

- Zero liability protection for unauthorized purchases.

- Chip-and-PIN technology for enhanced security.

- Ability to lock or unlock the card via the mobile app.

- 24/7 fraud monitoring and alerts.

With all these safeguards in place, you can feel confident knowing your prepaid Chase card is as secure as it gets.

Prepaid Chase Card vs. Other Cards

So how does the prepaid Chase card stack up against other prepaid cards on the market? To be honest, it’s one of the best options out there. While some cards may offer lower fees or extra perks, few can match the combination of reliability, security, and convenience that Chase provides.

For example, many prepaid cards require you to pay activation fees or maintenance fees just to keep the card active. With Chase, there’s no activation fee, and the monthly fee is easily waived if you meet the conditions. Plus, the ability to use Chase ATMs for free is a huge plus, especially if you live near one of their branches.

Comparison Table

| Feature | Prepaid Chase Card | Other Prepaid Cards |

|---|---|---|

| Monthly Fee | $4.95 (waived with direct deposit or $500+ monthly load) | $5-$9.95 (non-waivable in most cases) |

| ATM Withdrawal Fee | $2.50 at non-Chase ATMs | $2-$5 at non-network ATMs |

| Security Features | Zero liability, fraud monitoring, chip-and-PIN | Varies by issuer |

As you can see, the prepaid Chase card holds its own pretty well against the competition. It’s a solid choice for anyone looking for a reliable prepaid card with minimal fees and maximum security.

Who Should Use a Prepaid Chase Card?

Prepaid Chase cards are versatile tools that can benefit a wide range of people. Whether you’re trying to teach your teenager about financial responsibility, managing your own budget more effectively, or simply looking for a safer way to shop online, this card has something to offer.

Here are a few groups who might find prepaid Chase cards particularly useful:

- Students: Great for learning how to manage money without the risk of debt.

- Young Professionals: Ideal for building credit or avoiding high-interest credit card debt.

- Travelers: Perfect for making purchases abroad without worrying about carrying cash.

- Business Owners: Useful for managing petty cash or reimbursing employees.

No matter who you are, if you’re looking for a flexible, secure, and convenient financial tool, a prepaid Chase card could be the perfect fit.

Tips for Maximizing Your Prepaid Chase Card

Ready to get the most out of your prepaid Chase card? Here are a few tips to help you make the most of its features:

- Set up direct deposit to avoid monthly fees and get access to your paycheck up to two days early.

- Use Chase ATMs whenever possible to avoid withdrawal fees.

- Monitor your transactions regularly through the Chase app to catch any suspicious activity early.

- Take advantage of any special promotions or cashback offers available to cardholders.

By following these tips, you can enjoy all the benefits of your prepaid Chase card while minimizing costs and maximizing convenience.

Common Questions About Prepaid Chase Cards

Still have some questions? Here are answers to a few of the most common queries about prepaid Chase cards:

- Can I use my prepaid Chase card anywhere? Yes, wherever Visa or Mastercard is accepted, your prepaid Chase card will work.

- Is there a limit to how much I can load onto the card? Daily, monthly, and annual load limits apply, so be sure to check the terms and conditions.

- Can I earn rewards with my prepaid Chase card? Currently, prepaid cards do not offer rewards programs, but they do come with other perks