So, you're trying to figure out how to access the 5th 3rd bank login system? You're not alone. In today's fast-paced world, managing finances online has become more important than ever. Whether you're checking your balance, transferring funds, or paying bills, having secure access to your bank account is crucial. Let's dive into everything you need to know about logging in to 5th 3rd Bank and how to make the most of its features.

Imagine this: You're sitting at home, coffee in hand, and you suddenly need to check your account. But wait—how do you log in? What if you forget your password? Or worse, what if you encounter a security issue? Don't worry, we've got you covered. This article will walk you through the process step by step, ensuring you can access your account safely and efficiently.

Before we dive deeper, let's talk about why 5th 3rd Bank stands out. With its user-friendly interface, advanced security features, and customer support that actually listens, it's no wonder so many people trust this institution. Whether you're a long-time customer or just starting out, understanding how to log in properly is key to maximizing your banking experience.

Read also:Oregon Ducks Basketball Roster Your Ultimate Guide To The Ducks Lineup

Table of Contents

- Introduction to 5th 3rd Bank Login

- Benefits of Online Banking with 5th 3rd Bank

- Step-by-Step Guide to Logging In

- Ensuring Your Account's Security

- Common Issues and How to Fix Them

- Using the 5th 3rd Bank Mobile App

- Key Features of 5th 3rd Bank Online Services

- Customer Support Options

- Tips for Efficient Banking

- Conclusion: Making the Most of Your Banking Experience

Introduction to 5th 3rd Bank Login

Alright, let's get real here. Logging into your bank account shouldn't feel like solving a puzzle. The 5th 3rd Bank login system is designed to be as straightforward as possible, but sometimes, things can get tricky. Maybe you forgot your password, or maybe you're new to online banking altogether. No matter the situation, we'll break it down for you.

Why Online Banking Matters

In today's digital age, banking online isn't just convenient—it's essential. With 5th 3rd Bank, you can manage your finances from anywhere, anytime. From paying bills to setting up automatic transfers, the possibilities are endless. Plus, who doesn't love the peace of mind that comes with 24/7 access to your account?

Benefits of Online Banking with 5th 3rd Bank

Let's be honest—online banking offers way more than just convenience. Here are some of the top benefits of using 5th 3rd Bank's online services:

- Accessibility: Access your account anytime, anywhere, as long as you have an internet connection.

- Security: Advanced encryption and two-factor authentication ensure your information stays safe.

- Efficiency: Save time by automating payments, setting up alerts, and managing transactions all in one place.

- Customer Support: Need help? 5th 3rd Bank offers live chat, phone support, and a comprehensive help center.

And let's not forget the cool perks, like cashback rewards and personalized financial advice. It's like having a personal assistant for your money, but way cooler.

Step-by-Step Guide to Logging In

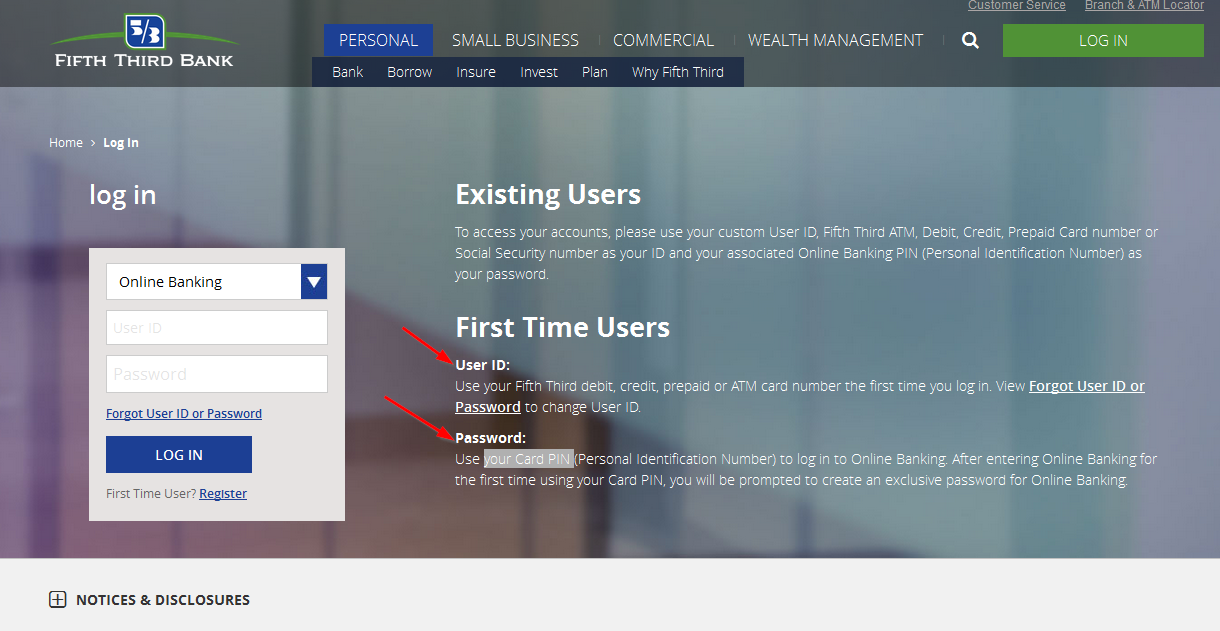

Alright, let's get practical. Here's how you can log in to your 5th 3rd Bank account in no time:

Step 1: Visit the Official Website

First things first, head over to the official 5th 3rd Bank website. Make sure you're typing the correct URL to avoid phishing scams. Pro tip: Bookmark the site for easy access later.

Read also:Arielle Kebbel Relationships The Untold Story Of Love Fame And Connection

Step 2: Enter Your Credentials

Once you're on the login page, enter your username and password. If you're logging in for the first time, you might need to set up your account credentials. Don't worry, it's super easy!

Step 3: Verify Your Identity

5th 3rd Bank takes security seriously. You might be asked to verify your identity through two-factor authentication. This could involve entering a code sent to your phone or email. It's an extra step, but trust us, it's worth it.

Ensuring Your Account's Security

Security should always be a top priority when it comes to online banking. Here are some tips to keep your 5th 3rd Bank account safe:

- Create a Strong Password: Use a mix of letters, numbers, and symbols. Avoid using easily guessable info like your birthday or pet's name.

- Enable Two-Factor Authentication: This adds an extra layer of protection, making it harder for hackers to access your account.

- Avoid Public Wi-Fi: Logging in on public networks can expose your information. Stick to secure, private connections whenever possible.

Remember, staying vigilant is key. If you notice any suspicious activity, report it to 5th 3rd Bank immediately. They've got your back, but it's always good to be proactive.

Common Issues and How to Fix Them

Even the best systems can have hiccups. Here are some common issues users face when logging into 5th 3rd Bank and how to solve them:

Forgot Your Password?

No worries, it happens to the best of us. Simply click the "Forgot Password" link on the login page. You'll be guided through a quick process to reset your password.

Account Locked Out?

If you've entered your credentials incorrectly too many times, your account might get temporarily locked. Don't panic—just contact customer support, and they'll help you regain access.

Using the 5th 3rd Bank Mobile App

Who needs a desktop when you've got a smartphone? The 5th 3rd Bank mobile app is a game-changer. Here's why you should download it:

- On-the-Go Access: Check your balance, pay bills, and transfer funds from anywhere.

- Push Notifications: Get real-time alerts for transactions and account activity.

- Easy Navigation: The app is designed with simplicity in mind, so you can find what you need quickly.

And let's not forget the cool features, like mobile check deposits and location-based ATMs. It's like having your bank in your pocket.

Key Features of 5th 3rd Bank Online Services

Now that you're logged in, let's explore all the awesome features 5th 3rd Bank has to offer:

Bill Payments

Say goodbye to late fees. With 5th 3rd Bank, you can schedule and pay bills directly from your account. It's like having a personal assistant for your finances.

Account Alerts

Stay on top of your money with customizable alerts. Get notified when your balance is low, when a transaction is made, or when a bill is due.

Investment Tools

Thinking about growing your wealth? 5th 3rd Bank offers a range of investment options, along with tools to help you make informed decisions.

Customer Support Options

Let's face it—sometimes, you just need to talk to a real person. Here's how you can reach 5th 3rd Bank's customer support:

- Live Chat: Get instant help through the bank's website or mobile app.

- Phone Support: Call their toll-free number for personalized assistance.

- Email Support: Send a message through the contact form, and they'll get back to you ASAP.

And let's not forget their comprehensive help center, filled with FAQs and troubleshooting guides. You're never alone with 5th 3rd Bank.

Tips for Efficient Banking

Ready to level up your banking game? Here are some tips to make the most of your 5th 3rd Bank experience:

- Set Up Automatic Transfers: Save time and avoid late fees by automating your payments and transfers.

- Use Budgeting Tools: Track your spending and set financial goals with the bank's built-in budgeting tools.

- Stay Organized: Keep all your important documents and statements in one place for easy access.

By following these tips, you'll be well on your way to mastering your finances in no time.

Conclusion: Making the Most of Your Banking Experience

And there you have it—everything you need to know about 5th 3rd Bank login and beyond. Whether you're a seasoned online banker or just getting started, this guide has got you covered. Remember, the key to a successful banking experience is staying informed, secure, and organized.

So, what are you waiting for? Head over to the 5th 3rd Bank website or download the app today. And don't forget to share this article with your friends and family. Who knows? You might just help someone else take control of their finances too.

Have any questions or feedback? Drop a comment below, and let's keep the conversation going. Happy banking, folks!