Let’s face it, folks—Apple Pay is awesome! It’s fast, secure, and oh-so-convenient. But what happens when something goes wrong with your Apple Pay transaction? Maybe you were charged twice, or you didn’t authorize a purchase, or maybe there’s an error on the receipt. Don’t panic! You’re not powerless. Knowing how to dispute an Apple Pay transaction can save you from losing hard-earned cash. So, buckle up and let’s dive into the nitty-gritty of fixing those pesky payment issues.

Whether you’re a seasoned Apple Pay user or just starting out, disputes can happen to anyone. The good news? Apple has built-in systems to help you resolve these issues quickly. This guide will walk you through everything you need to know about disputing transactions, from understanding your rights to taking action step-by-step.

So, why should you care about learning how to dispute an Apple Pay transaction? Well, think about it—your money is at stake here. You deserve to know your options, and more importantly, how to protect yourself in case of fraudulent or unauthorized charges. Let’s get started, shall we?

Read also:Is Tulsi Gabbard Married With Children Unveiling The Truth

Understanding Apple Pay and Your Rights

What Exactly is Apple Pay?

Before we jump into the dispute process, let’s break down what Apple Pay actually is. Apple Pay is a digital wallet service that allows you to make payments using your Apple devices, like your iPhone, Apple Watch, or iPad. It works by linking your credit or debit cards to the Wallet app, making it super easy to pay for stuff both online and in-store.

But here’s the kicker—while Apple Pay is super convenient, it’s not immune to errors. Sometimes, merchants make mistakes, or worse, someone might use your account without your permission. That’s where your rights come in.

Your Rights as an Apple Pay User

When it comes to disputing transactions, you have certain protections under federal law. For example, if someone uses your card information without your consent, you’re usually only liable for up to $50 under the Fair Credit Billing Act. However, most banks waive even that fee if you report the issue promptly.

Here’s the deal—you need to act fast. The sooner you report a suspicious transaction, the better your chances of getting your money back. So, don’t wait around hoping the problem will fix itself. Take charge!

How to Dispute an Apple Pay Transaction: Step-by-Step Guide

Step 1: Check Your Transaction History

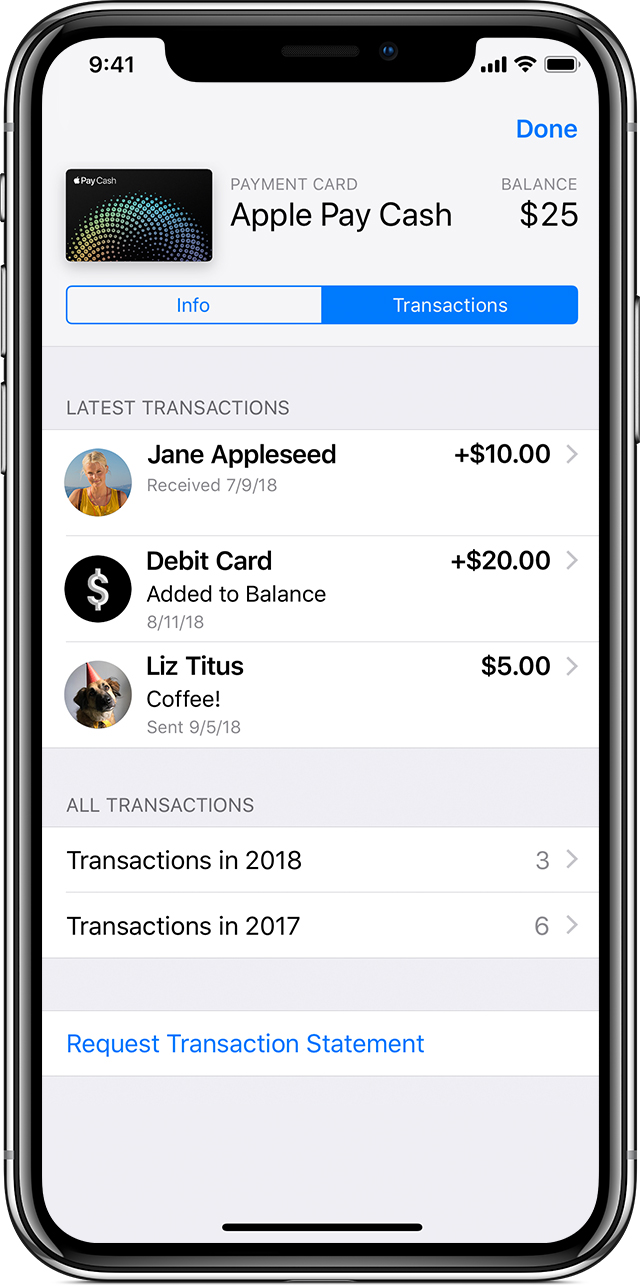

The first thing you need to do is review your transaction history. Open the Wallet app on your iPhone, tap the card you used for the transaction, and scroll down to see all your recent purchases. Look for anything that seems fishy or unfamiliar.

If you spot a suspicious charge, jot down the details—date, amount, merchant name, etc. Trust me, this info will come in handy later.

Read also:Conner Bedard The Rising Star Redefining The World Of Sports

Step 2: Contact the Merchant

Before jumping straight into a dispute, try reaching out to the merchant first. Sometimes, the issue might be a simple misunderstanding, like a pending charge that hasn’t cleared yet. Give the merchant a call or send them an email explaining the situation.

Remember, politeness goes a long way. Start with something like, “Hi, I noticed a charge on my account that I don’t recognize. Can you help me clarify this?” You’d be surprised how often this works!

Step 3: Contact Your Bank or Card Issuer

If the merchant can’t resolve the issue, it’s time to escalate things. Call your bank or card issuer and explain the situation. Be prepared to provide details about the transaction, including the date, amount, and merchant name.

Most banks have a dedicated fraud department that can assist you with disputing charges. They’ll usually guide you through the process and may even ask you to fill out a dispute form.

Common Reasons for Disputing an Apple Pay Transaction

Unauthorized Charges

One of the most common reasons for disputing an Apple Pay transaction is unauthorized charges. This happens when someone uses your card information without your permission. It could be a result of theft, hacking, or even a simple mix-up at the point of sale.

Pro tip: Always monitor your accounts regularly for any unusual activity. The sooner you catch an unauthorized charge, the easier it is to get it resolved.

Double Charges

Another common issue is double charges. This happens when the same transaction is processed twice, either by the merchant or the payment processor. While annoying, it’s usually easy to fix by contacting the merchant or your bank.

Just remember to stay calm and patient. Double charges can happen to anyone, and most merchants are happy to refund the extra charge once they’re made aware of the issue.

Incorrect Amounts

Sometimes, the amount charged doesn’t match the actual purchase price. This can happen due to errors in the checkout process or discrepancies between the advertised price and the final bill.

In cases like this, it’s important to gather as much evidence as possible. Save receipts, screenshots, and any other relevant documentation. This will strengthen your case when disputing the charge.

Tips for Avoiding Fraudulent Transactions

Enable Two-Factor Authentication

Two-factor authentication (2FA) adds an extra layer of security to your Apple Pay account. With 2FA enabled, even if someone gets hold of your card information, they won’t be able to access your account without the verification code sent to your device.

Setting up 2FA is easy—just go to Settings > [Your Name] > Password & Security and follow the prompts. Trust me, it’s worth the extra step.

Monitor Your Accounts Regularly

As I mentioned earlier, keeping an eye on your accounts is crucial. Set aside some time each week to review your transaction history and look for anything suspicious. It only takes a few minutes, but it could save you a lot of headaches down the line.

Some banks even offer alerts for unusual activity, so consider signing up for those if they’re available.

Use Strong Passwords

Weak passwords are a hacker’s dream. Make sure your Apple ID and any associated accounts are protected with strong, unique passwords. Avoid using obvious combinations like “123456” or “password.” Instead, opt for a mix of letters, numbers, and symbols.

And don’t forget to change your passwords regularly. It’s a simple step that can make a big difference in protecting your information.

What Happens After You Dispute a Transaction?

Investigation Process

Once you file a dispute, your bank or card issuer will launch an investigation. This process can take anywhere from a few days to a few weeks, depending on the complexity of the case.

During this time, the disputed amount is usually placed on hold, meaning the merchant won’t have access to it until the investigation is complete. This gives you peace of mind knowing that your money is safe while the issue is being resolved.

Possible Outcomes

There are a few possible outcomes after the investigation. If the dispute is in your favor, the disputed amount will be refunded to your account. If the merchant provides sufficient evidence to prove the charge was valid, the dispute may be denied.

Either way, you’ll receive a notification from your bank or card issuer with the final decision. If you’re not satisfied with the outcome, you may have the option to appeal the decision, depending on your bank’s policies.

Legal Protections for Apple Pay Users

Federal Laws and Regulations

As an Apple Pay user, you’re protected by several federal laws, including the Fair Credit Billing Act (FCBA) and the Electronic Fund Transfer Act (EFTA). These laws limit your liability for unauthorized charges and require banks to investigate disputes promptly.

Under the FCBA, you’re only responsible for up to $50 of unauthorized charges if you report the issue within 60 days of receiving your statement. The EFTA offers similar protections for debit card transactions.

State-Level Protections

In addition to federal laws, many states have their own consumer protection laws that provide additional safeguards for Apple Pay users. For example, some states require merchants to provide itemized receipts and prohibit them from charging hidden fees.

It’s always a good idea to familiarize yourself with the laws in your state, as they can vary significantly. Your state’s Attorney General’s office is a great resource for more information.

Common Mistakes to Avoid When Disputing Apple Pay Transactions

Not Acting Quickly Enough

One of the biggest mistakes people make when disputing Apple Pay transactions is waiting too long to take action. The longer you wait, the harder it becomes to resolve the issue. Most banks require you to report unauthorized charges within 60 days to be eligible for a refund.

So, if you notice something suspicious, don’t delay. Contact your bank or card issuer immediately to start the dispute process.

Not Keeping Records

Another common mistake is not keeping records of your communications with merchants and banks. Always save emails, notes from phone calls, and any other relevant documentation. This will make it easier to reference if the issue escalates.

Consider creating a folder on your computer or phone specifically for dispute-related documents. It’ll keep everything organized and easily accessible.

Arguing Instead of Explaining

Finally, avoid getting into arguments with customer service representatives. Remember, they’re there to help you. Approach the situation calmly and explain your issue clearly and concisely.

If you encounter resistance, politely ask to speak to a supervisor or escalate the issue to a higher level. Persistence pays off, but always keep things professional.

Conclusion

Disputing an Apple Pay transaction doesn’t have to be a headache. By following the steps outlined in this guide, you can protect your money and ensure that any issues are resolved quickly and efficiently.

Remember, your rights as an Apple Pay user are protected by federal and state laws. Don’t hesitate to exercise those rights if you encounter a problem. And most importantly, stay vigilant by monitoring your accounts regularly and taking steps to prevent fraud.

So, what are you waiting for? Go ahead and take control of your finances. If you found this guide helpful, don’t forget to share it with your friends and family. Together, we can make the world of digital payments a safer place for everyone!

Table of Contents

- How to Dispute Apple Pay Transaction: A Comprehensive Guide to Protect Your Money

- Understanding Apple Pay and Your Rights

- What Exactly is Apple Pay?

- Your Rights as an Apple Pay User

- How to Dispute an Apple Pay Transaction: Step-by-Step Guide

- Step 1: Check Your Transaction History

- Step 2: Contact the Merchant

- Step 3: Contact Your Bank or Card Issuer

- Common Reasons for Disputing an Apple Pay Transaction

- Unauthorized Charges

- Double Charges

- Incorrect Amounts

- Tips for Avoiding Fraudulent Transactions

- Enable Two-Factor Authentication

- Monitor Your Accounts Regularly

- Use Strong Passwords